Potential of Electric Vehicles

By Evan Wang

Electric vehicles (EV) have long been at the forefront of discussions of a green transition, but what are the circumstances surrounding their deployal today? What is their potential going forward, especially with the pandemic and America’s new administration?

First, let’s look at some overall global trends for electric vehicles. According to an EV outlook report conducted by the International Energy Agency (IEA), 2.1 million EV sales in 2019 mark a 6% growth from the previous year, and unsurprisingly, the global electric car stock has been steadily increasing.

Technological potential is likely to drive further growth. Electrifying heavy-duty trucks and air and sea shipping methods provides a unique opportunity for cost and emissions saving. New high-power and dynamic charging systems may increase usage of long-haul usage of electrification for long-haul shipping. According to the IEA report, Li-ion technology has made tremendous progress in terms of energy density, cell life, and thermal management; battery capacity and costs are also projected to improve by bounds. In addition, since electricity supply is relying less on fossil fuels, the emissions benefits of EV will also improve. The IEA report predicts that in a sustainable development scenario, the amount of battery energy available for repurposing or recycling will go from 0.9 GWh per year in 2019 to 122.2 GWh per year in 2030.

However, although the future is bright, there are certain factors to take into consideration for further improvement. Decreasing emissions during the mining and refining processes for EV raw materials will be crucial, especially for aluminum, nickel, cobalt, and graphite. In addition, how batteries are recycled or disposed of after use significantly impacts their impact on emissions.

Policy also looks promising for promoting EV growth. Europe, China, and the US are increasingly mandating electrification of shipping operations at ports, and both the EU and China have strengthened the New Energy Vehicle Mandate. In more recent news for the US, with the new administration’s renewed focus on the climate, Biden plans to replace all 645,000 federal vehicles (trucks, construction vehicles, armored trucks, passenger cars, etc.) with domestically produced EVs. While this sounds promising, specifics of the timeline are unclear. If Biden wanted to achieve this goal in the next 5 years, the government would have to buy about 129,000 new cars every year. In 2019, there were fewer than 250,000 EVs sold in the US in total. Furthermore, the size of the federal fleet pales in comparison to the American private automobile industry. In 2019, the federal fleet accounted for only 0.02% of the country’s total gasoline usage. Therefore, Biden’s plan to electrify government vehicles should be judged based on how it affects (and hopefully spurs) EV adoption nationwide.

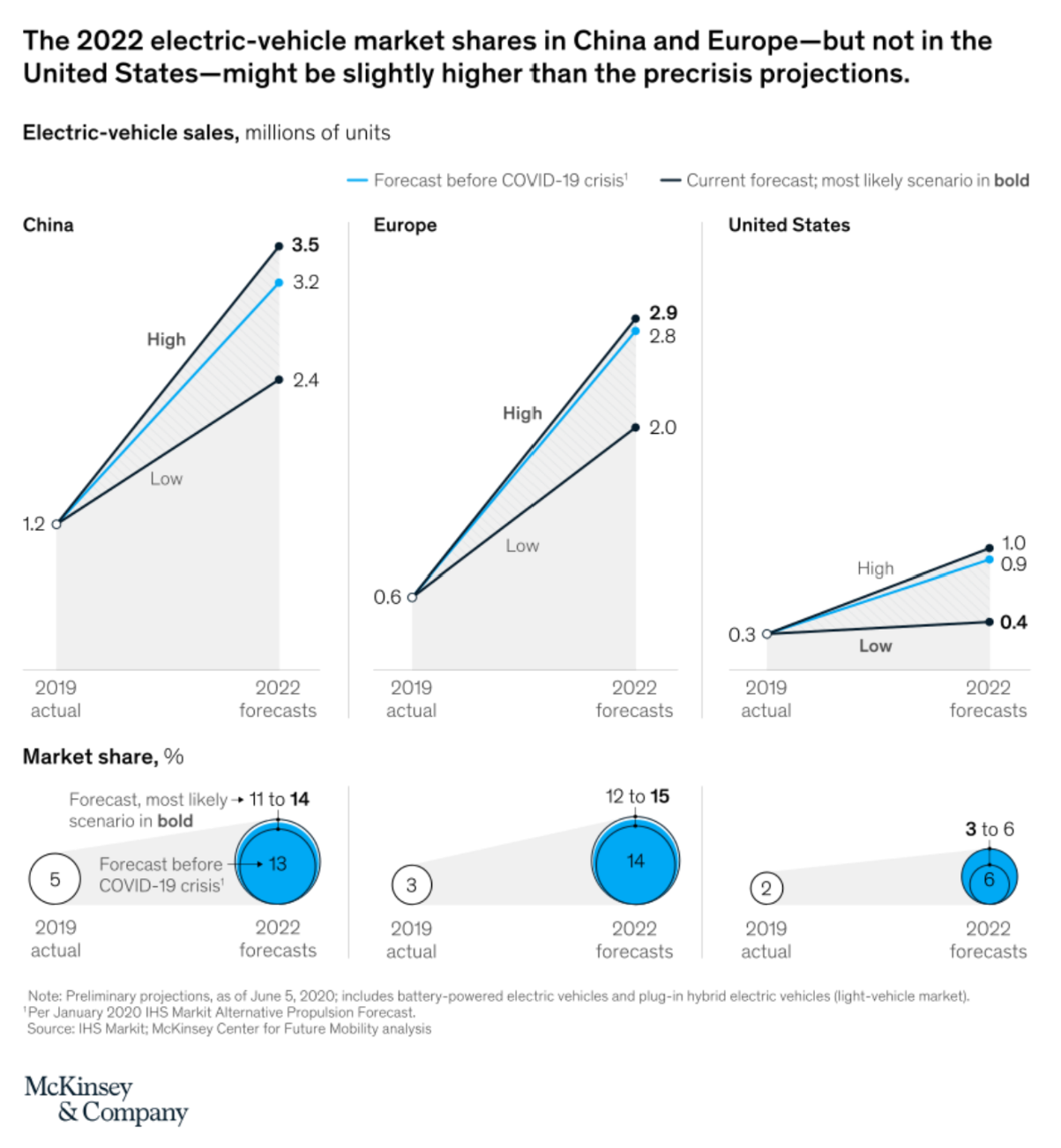

With regards to the COVID-19 pandemic, the car market is predicted to contract by around 15%. There are also other added challenges. Low oil prices and restrictions on public transportation may increase car traffic and emissions. So, cities should focus on strengthening policies to mitigate these impacts. Moreover, targeted measures to support EV sales in stimulus packages are also necessary. The International Energy Agency report finds that historically, stimulus measures have boosted diesel cars, increasing oil demand and pollution. Present stimulus should avoid this mistake. China and the EU have focused on promoting EVs and subsidizing the construction of charging stations as part of their stimulus programs. Because of this, a report by the McKinsey Global Institute, predicts that in 2022, EV market shares in the two countries may actually be slightly higher than pre-covid predictions.

In the long-term, McKinsey predicts that emissions regulations and incentives will likely propel EV market share in China to 35-50 % by 2030, and 35-45 % in Europe. Growth in the US is predicted to be slower, predicted to reach around 15-35 % by 2030. Of course, these predictions are variable and subject to change, and hopefully the US takes initiative to accelerate the green transition.

In conclusion, the potential for EVs to contribute to a net-zero state is high, driven by political interest, market engagement, and technological development. However, the mining, fabrication, and disposal processes of systems should be refined to decrease environmental impact, and stimulus packages in the pandemic environment should avoid mistakes of the past and focus on promoting EVs over diesel.